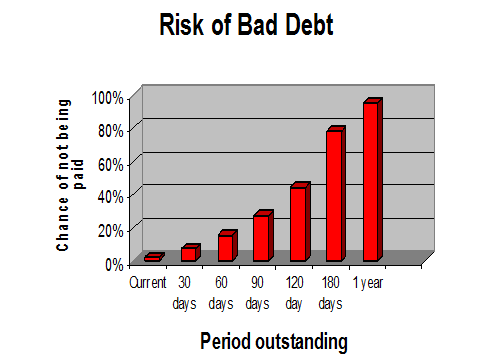

Most businesses need to sell at least some goods or services on credit. The risk of a bad debt begins immediately your goods are delivered or your professional services are provided to your customer. Good credit control and sound debtor management are vital to reduce bad debt risk. The risk of loss increases rapidly with time…

Bad debtors are rarely classed as criminals but they have the same effect. For every $5,000 lost through bad debts, most businesses have to increase their sales by $30,000 to $50,000 just to recover that loss.Lack of effective credit control substantially increases the risk of not being paid and costs you money every day that accounts are allowed to continue unpaid.

$30,000 to $50,000 just to recover that loss.Lack of effective credit control substantially increases the risk of not being paid and costs you money every day that accounts are allowed to continue unpaid.

The Risk of Bad Debt

At 60 days (about the Australian payment time). Risk = 15%

At 90 days risk of losing your money is around 25%

After 180 days the chance of you never getting paid exceeds 50%

After that, the prospects of seeing your money are slim and get worse with every passing week.

Do you have specific and effective credit management processes?

- Do you issue invoices and statements on time?

- Is someone in your business responsible for following up overdue accounts?

- Are the right people talking to your customers about unpaid accounts?

If you answer “No” to any of these questions then you need to consider outsourcing your accounts receivable

What about Factoring?

The selling of your debtor ledger to a financial organisation will certainly get you paid but at a much lesser rate than the face value of the invoices outstanding. You may have to sign over all future invoices too so that you may not receive the full worth for your products or services.

Before you even consider factoring your debts you should be looking at a sound credit management system such as offered by Accounts Receivable Solutions. After all you’ve performed your service or sold the product at a given price, surely you deserve to receive the full amount rightfully owing to you.